Tokyo’s office market is experiencing a notable rent hike wave.

As of October 2025, office rents in Tokyo’s core business districts rose by 10% year-on-year. Marunouchi, the area with the highest rents, reported a 0% vacancy rate with an average rent reaching RMB718 per square meter per month. According to the 2025 H2 Office Rent Survey released by the Nikkei, the rent index for existing office buildings in Tokyo (completed for over one year) soared 10% year-on-year to hit 168.89. This growth rate far outpaces Japan’s current CPI growth of 2%–3%, setting a new record high since the "minor real estate bubble" period in the first half of 2008.

Indexed to 100 based on the rent level in February 1985, the data shows that the rent index for existing Tokyo office buildings in H2 2025 (as of September) stood at 168.89, an increase of 14.82 points compared with H2 2024. Since rent movements of existing office buildings dominate the leasing market, this figure directly reflects the significant shift in the supply-demand dynamics of Tokyo’s office market—high-quality, well-equipped large office buildings in prime core locations have become the focal point of competition among enterprises.

The core driver behind this rent surge stems from structural changes in Japan’s labor market. As business activities that contracted during the COVID-19 pandemic have fully recovered, enterprises are expanding their scale, while the structural labor shortage caused by population decline has become increasingly prominent. To gain an edge in the fierce talent competition, Japanese enterprises have begun to regard office space upgrading as a key factor, in addition to raising salaries, and are incorporating rent costs into the scope of human capital investment.

Yoshio Nakayama, President of XYMAX Research Institute (Minato-ku, Tokyo), a real estate research firm, pointed out: "The office rent per employee accounts for about one-tenth of labor costs. Nowadays, more and more business operators realize that a high-quality office environment is an important chip to attract and retain talents. Rent burden is no longer simply regarded as a cost, but a necessary investment in human capital."

This trend has been reflected in the office layout adjustments of several well-known enterprises:

(1) Amazon Japan has decided to set up a new office in Azabudai Hills, Minato-ku, Tokyo, which opened in 2023.

(2) Honda plans to relocate its headquarters functions to a newly built property in Yaesu, in front of JR Tokyo Station, as early as 2029, aiming to deepen cross-department communication among internal employees and drive innovation by leveraging the spacious single-floor space.

(3) Kracie also announced that it will move its headquarters to THE LINKPILLAR2 in 2027, a building scheduled to open in 2026 in front of JR Takanawa Gateway Station, Minato-ku, Tokyo. The company stated that the new location is not only close to the current headquarters to ensure employee commuting convenience, but also can rely on the advantages of large office buildings to deepen internal and external corporate cooperation and support the company’s development.

From a market logic perspective, the skyrocketing office rents in Tokyo are essentially the result of the combined effects of structural changes in Japan’s labor market and adjustments in corporate competition strategies. Labor shortage caused by population decline is a long-term structural challenge. Therefore, enterprises’ strategy of upgrading office environments to enhance employer brand appeal will not change. This means that competition for top-tier office resources will continue to intensify, and the high rent trend in Tokyo’s office market, especially in core areas, will persist in the foreseeable future.

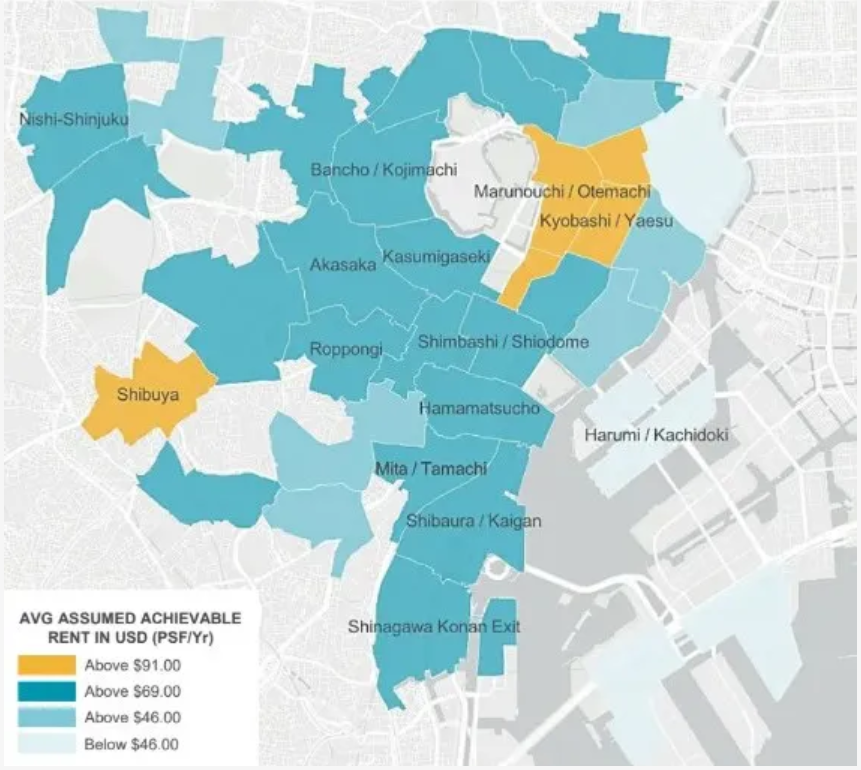

Area (English/Japanese) | Vacancy Rate | Average Rent (CNY/sq. ft/year) |

|---|---|---|

Marunouchi (Marunouchi / Otemachi) | 0.0% | 801.31 |

Kyobashi (Kyobashi / Yaesu) | 0.2% | 733.45 |

Shibuya (Shibuya) | 0.1% | 681.57 |

Kasumigaseki (Kasumigaseki) | 2.3% | 669.37 |

Roppongi (Roppongi) | 1.8% | 635.62 |

Kasumigaseki (Kasumigaseki) | 0.6% | 581.32 |