In recent years, as a growing number of Chinese-funded enterprises have established a presence in Cairo, the rental prices of premium office buildings in the city's core areas have reached the level of CBDs in first-tier cities in China currently. The cost of office space for Chinese enterprises setting up operations here is equivalent to that of opening branch offices in the downtown areas of China's first-tier cities. Even so, the allure of this blue - ocean market continues to attract a large number of Chinese businesses to expand into Egypt.

On November 25th, Mr. Waleid Gamal El-Dien, Chairman of the Suez Canal Economic Zone (SCZone), and Mr. Si Yong, Director - General of the Jiangsu Provincial Department of Commerce, attended the Jiangsu - Egypt Economic and Trade Cooperation Conference held in Cairo. The conference aimed to further promote investment and trade cooperation between enterprises from Jiangsu and Egypt, particularly to strengthen in-depth connection with the SCZone. Meanwhile, it responded to the Belt and Road Initiative and Egypt's Vision 2030.

In his speech at the conference, Chairman Gamal El-Dien released a set of encouraging data:

Over the past three and a half years, the SCZone has attracted a total of 11.6 billion US dollars in foreign investment, half of which came from Chinese enterprises.

Between 2024 and 2025, the SCZone has witnessed several large - scale Chinese - funded factory projects either under construction or in the planning stage. These include: Sailun Tire's 350,000 - square - meter tire factory (the 150,000 - square - meter first phase of the factory has been capped); Qibin Group's 800,000 - square - meter solar panel base; the second phase of the refrigerator and freezer factory at Haier Egypt Eco - Park; Midea's 830 million yuan new base project for refrigerators and washing machines; and the fourth - phase expansion of Jushi Egypt involving the addition of new tank furnaces and supporting workshops.

At the same time, the SCZone announced the official signing of an agreement with WINPEX Group from Ningbo, China. The group will invest 15 million US dollars to construct a production base for lighting and electrical appliances in the Ain Sokhna Integrated Zone within the SCZone. Covering an area of 50,000 square meters, the factory will mainly produce solar lamps, LED bulbs, electronic devices and plastic tools. All its products will be for export, and it is expected to directly create 500 job opportunities. This project ranks as the largest - scale investment among Chinese manufacturing projects attracted by the SCZone so far this year.

Why Egypt? A "Strategic Springboard" Fueled by the Overlay of Three Advantages

The collective choice of Egypt by Chinese enterprises is by no means accidental; instead, it results from the precise combination of three strategic dividends:

1. A Safe Haven from Trade Barriers

In recent years, global trade barriers have been on the rise. The European Union has imposed anti - subsidy duties of up to 38.3% on Chinese electric vehicles, and the United States has maintained its high - tariff system under Section 301. In stark contrast, Egypt enjoys tariff - free access to both European and American markets:

(1)It benefits from zero tariffs on industrial products exported to the European Union under the Euro - Mediterranean Agreement Establishing an Association between the European Communities and the Arab Republic of Egypt, and will be temporarily exempted from the Carbon Border Adjustment Mechanism (CBAM) until 2026.

(2)Under the Egypt - US Qualified Industrial Zones (QIZ) Agreement, products can enter the US market duty - free as long as their local content rate in Egypt reaches 35%.

Against such an international trade landscape, the model of "Chinese technology plus Egyptian manufacturing" has become an optimal path to bypass European and American tariff barriers and achieve global layout.

2. A Super Package of Policy Incentives

The Suez Canal Economic Zone has rolled out robust preferential policies, including zero land costs, a 10 - year exemption from customs duties and a five - year exemption from corporate income tax. Moreover, the China - Egypt TEDA Suez Economic and Trade Cooperation Zone has started to provide turnkey standard workshops, enabling enterprises to start production in as fast as three months. Since the 2024 China - Egypt Investment Forum, the Egyptian government has additionally allocated 500 million US dollars for the expansion of industrial corridors and the construction of 12 new logistics parks.

3. An Irreplaceable Geographical Location

Egypt is strategically positioned at the intersection of Europe, Africa and Asia. The Suez Canal, an arterial route for global trade, handles 12% of the world's annual cargo volume. Goods shipped from the TEDA Cooperation Zone can reach European ports in as few as 10 days, which is nearly 20 days faster than shipments from East Asia. In the context of global supply chain competition, this translates to a decisive edge in efficiency and vitality. Meanwhile, Egypt and its surrounding regions form a market of 1 billion people, where there is a strong demand for home appliances, tires, building materials and food.

Thanks to these unique advantages in policy and geography, Egypt has become a highly favored destination for Chinese enterprises seeking overseas expansion.

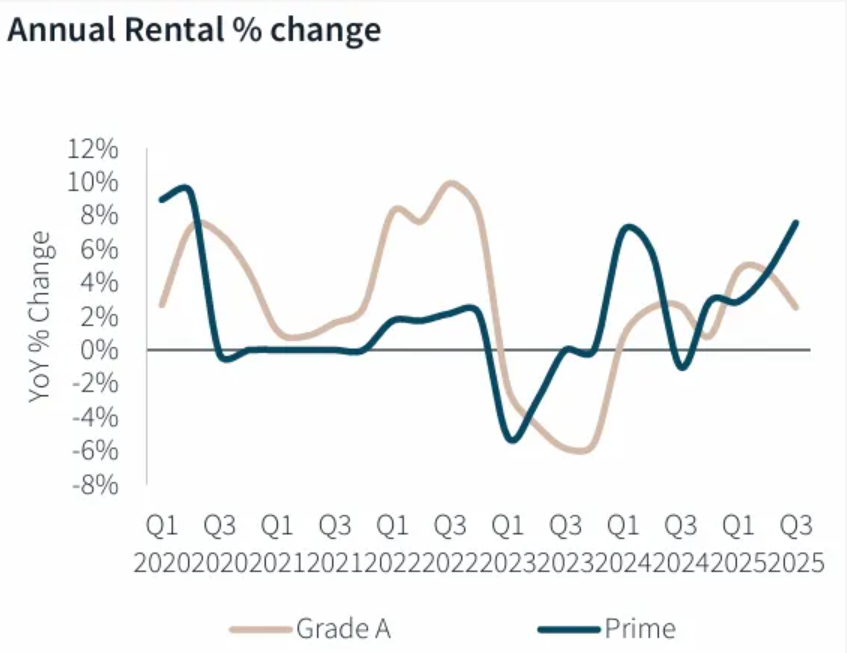

According to the professional data on Cairo's office building market in Q3 2025 provided by Kunity:

The total existing stock of office space in Cairo stood at 2.5 million square meters in Q3 2025. An additional 173,200 square meters is expected to enter the market in Q4. The overall vacancy rate is 9.0%. As for the average rental prices across the market, the premium buildings in core areas reached 271 RMB per square meter per month, representing a year - on - year increase of 7.6%; Grade A buildings hit 197 RMB per square meter per month, with a year - on - year growth of 2.5%. This latest data indicates that the average rent of premium office buildings in Cairo's core areas has now matched the level of CBDs in first - tier cities in China.