For Chinese enterprises venturing overseas, Europe has always held profound strategic value and significance. As two core countries in Europe, the UK and France are replete with both opportunities and challenges. Today, Kunity will sort out the latest industrial advantages, policy orientations and commercial real estate status of these two countries from a professional perspective, backed by up-to-date market data.

(I) The UK: A High-Value Pivot Driven by Finance and Technology Dual Cores

The UK maintains its position as a strategic highland for overseas expansion in Europe by virtue of two core strengths. First, as a world-class financial hub, it accounts for 40% of the global foreign exchange trading volume, providing efficient financing support for capital-intensive industries. Second, it stands as a highland for technological innovation, with the valuation of its tech ecosystem ranking third globally.

At the national strategic level, the UK government now focuses on eight high-growth sectors including artificial intelligence, quantum computing, clean energy and life sciences. It has clearly set the goal of becoming the world's third-largest economy by 2035, while making national-level investment arrangements. The UK boasts a stable legal system, a highly developed private economy, and a low average tariff rate of 2.5% for WTO member states, which together form a highly attractive foreign investment environment.

Chinese enterprises' investment in the UK has completed structural upgrading, shifting from traditional sectors such as real estate and hotels in the early stage to strategic emerging industries including new energy, high technology and cross-border logistics. In 2024, the investment volume hit a five-year high, and more than half of Chinese enterprises operating in the UK achieved profitability.

Core ChallengesThe main core challenges in the UK market are as follows:

(1)A rigorous national security review mechanism covering 17 sensitive industries.

(2)The world's strictest anti-bribery and data compliance regulations.

(3)Political uncertainties triggered by the international situation.

Recommendations for Chinese EnterprisesBased on these characteristics, Chinese enterprises in the UK should focus on the following aspects:

(1)Industry Selection: Avoid sensitive industries as much as possible, and prioritize areas with complementary advantages (e.g., green technology, consumer technology).

(2)Compliance Foundation: Establish a local legal team and build a robust compliance system, especially in anti-bribery and data compliance.

(3)Local Community Integration: Promote the localization of senior management and the management team, and integrate into the local culture.

(4)Regional Positioning: Position the UK as a hub to cover business across Europe.

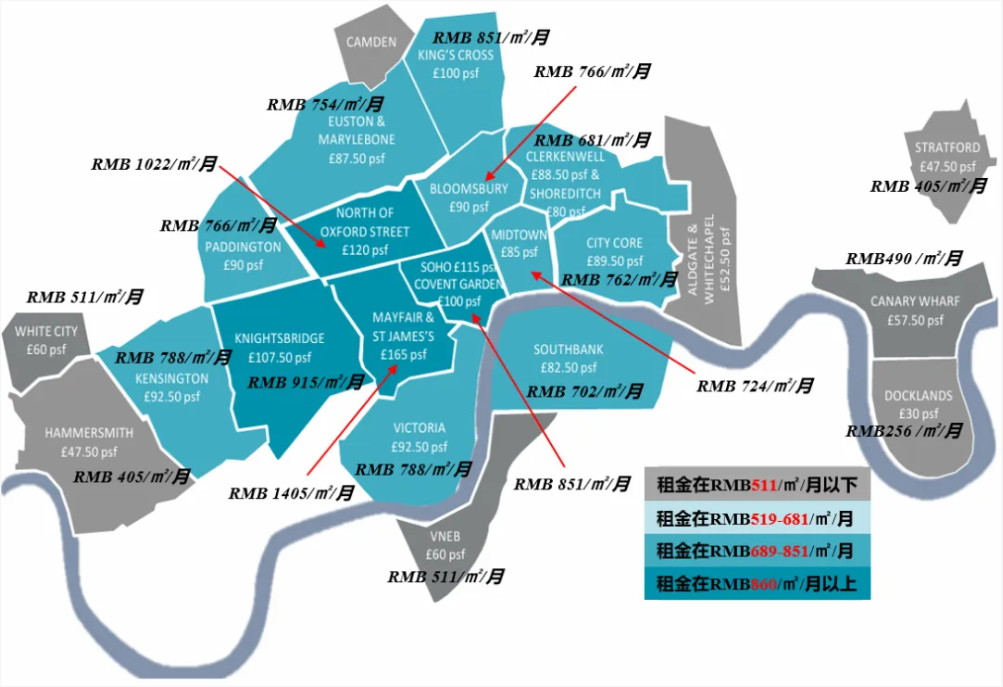

As a global financial center, the UK has relatively high office rental costs. According to the professional Q3 2025 data on London's office building market provided by Kunity:

Total existing office stock in London: 27.79 million square feet

Under-construction office space: 14.16 million square feet

Overall vacancy rate: 9.34%

Average rent of premium office buildings: Approximately RMB704.61 per square meter per month

Rents in the prime downtown areas even exceed RMB1,000 per square meter per month, ranking the highest in Europe overall.

(London CBD Area Division Map, Data Source: Q3 2025)

(II) France: Structural Opportunities Under the Reindustrialization Strategy

As a core member state of the EU, France's economic foundation mainly revolves around several traditional pillar industries including nuclear energy, aerospace, automobile manufacturing and luxury goods. These industries are stable but lack growth potential. The launch of the France 2030 plan, involving €30 billion, is committed to accelerating the market's transformation towards six key areas: energy decarbonization, green transportation, semiconductors, biomedicine, agro-food and sovereign technology, enhancing industrial competitiveness and making it the core of national strategy.

Chinese investment in France has shifted from traditional mergers and acquisitions to high-tech greenfield investments, which are highly aligned with France's national strategy:

Enterprises such as Envision AESC and Daqo New Energy have established large-scale battery and photovoltaic module factories, which not only align with energy decarbonization goals but also create a large number of local jobs.

BYD maintains rapid growth in the French electric vehicle market.

Wanhua Chemical and Xinyu Group have integrated into high-end manufacturing and nuclear industry supply chains through acquisitions or technological cooperation.

Cross-border e-commerce platforms like Temu have rapidly reshaped the local e-commerce landscape.

Core ChallengesThe main core challenges in the French market are as follows:

(1)Foreign investment reviews have extended to "future technologies" such as biotechnology and critical raw materials, with higher thresholds.

(2)Direct impacts from EU trade protection policies (e.g., additional tariffs on Chinese electric vehicles).

(3)Potential threats to supply chain stability posed by the "protest culture".

Recommendations for Chinese Enterprises Based on these characteristics, Chinese enterprises in France should focus on the following aspects:

(1)Seize Policy Dividends: Proactively deploy in the key areas of the "France 2030" plan, and participate in France's energy transition and reindustrialization process through greenfield investment.

(2)Local Cooperation: Prioritize local factory construction and technological cooperation models to circumvent EU tariff barriers.

(3)Strengthen Compliance and Resilience: Strictly comply with EU and French regulations on environmental protection, labor and data, and establish alternative supply chain plans to respond to social unrest.

Compared with other EU countries, France's office rental costs are also quite high. According to the professional Q3 2025 data on the Paris metropolitan area's office building market provided by Kunity:

Total existing office stock in the Paris area: 6.126 billion square meters

Future office supply: 1.7633 billion square meters

Overall vacancy rate: 10%

Average rent of premium office buildings: Approximately RMB452.83 per square meter per month

Rents for high-quality properties in the downtown area are high with sufficient demand, while demand in the surrounding areas is low and rents have slightly declined.