As Mainland Internet Traffic Dividend Peaks, Hong Kong Emerges as a "Golden Springboard" for E-commerce Giants' New Growth

In 2025, JD.com's bold move of acquiring a prime office building in Central Hong Kong for HK$3.5 billion kicked off a wave of collective expansion by major Mainland internet giants into the Hong Kong market. Alibaba, Pinduoduo, Meituan, and Xiaohongshu have all stepped up their efforts one after another. A fierce battle for the Hong Kong market is already underway, and behind this competition lies Chinese brands' core ambition to march toward globalization.

01 JD.com: The HK$3.5 Billion Building Purchase Is Just the Start, Deep-Rooting in Hong Kong with Supply Chain at Its Core

JD.com's layout in Hong Kong has never been a "single-point assault" but an all-dimensional in-depth rooting. According to the latest market news, the entity controlled by JD.com finally acquired a 50% stake in CCB Tower in Central Hong Kong from Lai Sun Group for HK$3.5 billion, a landmark move in its Hong Kong deployment. Hailed as a "golden landmark" in Central, this top-tier Grade A office building is located at 3 Connaught Road Central. Previously the Hong Kong Regent Hotel, it occupies a prime location in Central with an underground passage directly connecting to the MTR station. Boasting an office area of 11,200 square meters, it will become a crucial hub for JD.com in Hong Kong and even the Asia-Pacific region.

JD.com clearly stated that it has always been optimistic about its development in Hong Kong and will continue to invest around the supply chain to integrate its retail, logistics, technological R&D and other businesses into the region. This property acquisition is not JD.com's first in Hong Kong. Earlier, JD Smart Industry & Logistics Properties purchased the logistics property of Li & Fung Center in Sha Tin, Hong Kong for HK$1.8 billion, with a construction area of 45,000 square meters, marking its first industrial project in Hong Kong. JD Logistics has also built four fully self-operated express operation centers in Kwun Tong, Kwai Tsing, Sha Tin and Yuen Long. In terms of services, JD.com has spared no expense. In September 2024, it announced an initial investment of RMB1.5 billion in commodity pricing, logistics subsidies and service upgrades, with no upper limit on long-term investment.

This series of moves fully demonstrates JD.com's determination to gain a firm foothold in Hong Kong.

02 Fierce Competition: Alibaba, Pinduoduo, Meituan and Xiaohongshu All Make Their Moves

JD.com's heavy investment and layout are just a microcosm of major giants seizing the Hong Kong market. In fact, players such as Alibaba, Pinduoduo, Meituan and Xiaohongshu have already entered the market one after another, and Hong Kong has clearly become a new battlefield for large Mainland enterprises.

Alibaba has also made large-scale moves in Hong Kong. In September 2024, Taobao announced an investment of RMB1 billion to turn Hong Kong into a "free shipping area", launching a limited-time service of free shipping to Hong Kong for orders over RMB99. At the same time, it increased the number of Cainiao self-pickup points and lockers in Hong Kong to 800, covering key business districts. In October 2025, Alibaba, together with Ant Group, acquired 13 floors of office space in One Causeway Bay in Causeway Bay for HK$7.2 billion. Joseph Tsai, Chairman of Alibaba, said frankly that this acquisition demonstrates confidence in Hong Kong's business environment, and Hong Kong will become an ideal base for Alibaba to expand its international business.

Pinduoduo has started from the user side. In 2024, it launched a free shipping service to Hong Kong, where merchants cover the domestic shipping costs and the platform subsidizes cross-border shipping fees, reducing consumers' shopping costs. Since launching its international food delivery brand Keeta in Hong Kong in 2023, Meituan has expanded vigorously in overseas markets and even successfully entered Saudi Arabia. In June 2025, Xiaohongshu set up its first overseas office in Hong Kong. It plans to leverage Hong Kong's hub advantages to build a two-way link between Mainland and overseas brands—helping overseas brands connect with Mainland consumers while supporting Mainland brands to expand into the Hong Kong and global markets.

03 Betting on Hong Kong: A Global Choice After Traffic Peaks

There is a clear strategic logic behind the giants gathering in Hong Kong. Firstly, the local Hong Kong market still has huge potential. In January 2025, Hong Kong's total retail sales reached HK$35.3 billion, but online sales accounted for only 6.9%, much lower than that in the Mainland, leaving enormous room for online retail penetration. With the fading of the internet traffic dividend in the Mainland, this underdeveloped market has naturally become a key area for giants to seek new growth drivers.

Secondly, and most importantly, Hong Kong has an irreplaceable geographical advantage. As a core hub connecting the Mainland and the international market, Hong Kong has become a key node in the overseas expansion strategy of Chinese enterprises.

Hong Kong's "One Country, Two Systems" system endows it with unique institutional advantages. For international investors, investing in Chinese enterprises listed in Hong Kong is more acceptable both psychologically and in terms of capital arrangement than investing directly in the Mainland. Hong Kong bridges the geopolitical gap between the home countries of ultimate investors and the host country, serving as a vital buffer for international capital to enter the Chinese market.

Hong Kong's mature business environment and its inclusiveness and innovation towards diverse listing structures enable Chinese enterprises to raise funds from international capital in Hong Kong. The unique A-share and H-share dual-listing model has become a standard option for high-quality Chinese enterprises. A notable trend in Hong Kong's IPO market since 2021 is that 90% of newly listed companies are from the Mainland. One of the important purposes of these enterprises raising funds in Hong Kong is to support their overseas expansion strategies, using Hong Kong as a springboard to help their brands go global.

As major e-commerce giants continue to increase their investment, a head-on confrontation is inevitable. JD.com's supply chain advantages, Alibaba's ecological layout, Pinduoduo's low-price strategy, Meituan's local lifestyle experience and Xiaohongshu's content-driven traffic will spark intense competition in the Hong Kong market. This competition will not only reshape Hong Kong's retail market pattern—promoting higher online penetration and bringing consumers a richer variety of products, more favorable prices and better services. More importantly, with Hong Kong as a fulcrum, leading Chinese enterprises from various industries will take their mature, high-quality local brands to the world, truly transforming from "Mainland giants" into "global players". Against the backdrop of rising geopolitical risks and growing trade protectionism, Hong Kong's international legal environment, professional service system and diversified investor structure provide Chinese enterprises with crucial risk diversification and resource allocation functions. The profound transformation of Hong Kong's commercial market has only just begun.

Kunity's Latest Quarterly Market Analysis for Hong Kong, China

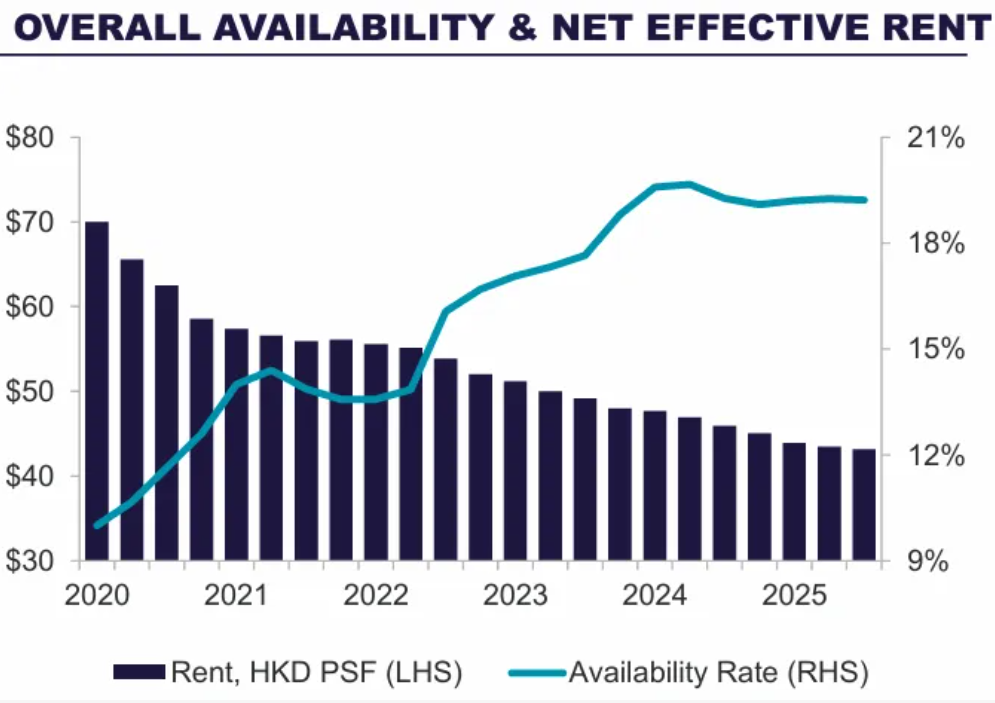

(1) Hong Kong's office leasing market witnessed an unprecedented level of activity in Q3 2025. The net absorption volume in Q3 reached 401,000 square feet (approximately 37,254.12 square meters), the highest since Q2 2019.

(2) The total existing stock across the entire Hong Kong market stands at 71,961,635 square feet (approximately 6,685,454.65 square meters).

The overall vacancy rate is 19.2%.

(3) The expected new supply in the future amounts to 5,069,700 square feet (approximately 470,990.54 square meters).

(4) The overall average rent is HK$43.1 per square foot per month (approximately RMB426.98 per square meter per month). In core areas such as Central, the average rent reaches HK$76.4 per square foot per month (approximately RMB756.87 per square meter per month).

As market demand increasingly leans toward high-standard premium office buildings, the gap in rent and vacancy rates between high-grade office buildings and those of other grades is expected to widen further. The overall average rent will continue its downward trend since the pandemic, but the decline is projected to remain moderate at a range of 4% - 6%.