A recent important update to Saudi Arabia’s work visa policy requires high attention from enterprises planning to test the Saudi market with a low-cost strategy:

The Ministry of Human Resources and Social Development (MHRSD) has substantially tightened the review logic for work visas (Iqama/Work Permit) for foreign executives. After the new policy takes effect, foreign-funded enterprises that previously relied on low-cost models such as "address hosting" or "co-working spaces" will be directly excluded from the visa approval system.

1. Low-Cost Shortcuts Blocked, Work Visa Threshold Raised

In recent years, with the advancement of Saudi Arabia’s "Vision 2030", core cities such as Riyadh have become popular destinations for Chinese-funded enterprises expanding overseas.

To quickly establish a presence and control initial costs, many overseas enterprises adopted a "workaround strategy" when first entering Saudi Arabia — prioritizing the resolution of work visa issues for management through address hosting, and gradually advancing physical operation after the business is up and running.

However, this model has now been completely negated by the new policy. According to the latest implementation guidelines of MHRSD, when enterprises apply for new Work Permits for executives, the system will compulsorily verify one of the following two conditions; applications that fail to meet the requirements will be directly rejected:

(1) The enterprise has submitted the Balady Municipal Commercial License (i.e., possesses a genuine office address that meets the requirements);

(2) The enterprise has reached the required Saudization (Nitaqat) level.

For newly registered foreign-funded companies that have not yet established a physical office space, this change will directly break their previous low-cost market entry logic.

2. Compliance Paths Under the New Policy: Clear but with Multiplied Costs

Under the new policy, there are only two compliant paths for enterprises to obtain work visas for executives, both of which require bearing higher capital and time costs:

Path 1: Lease a Compliant Physical Office

Enterprises must lease a physical office that complies with municipal regulations in Saudi Arabia, complete renovation and acceptance, pass Balady approval, and finally obtain an official commercial address. This means enterprises must bear two types of costs:

(1) Recurring rent expenses;

(2) Time costs for renovation, acceptance, and municipal approval processes.

Path 2: Meet Saudization (Nitaqat) Requirements

If the enterprise is temporarily unable to lease a physical office, it must hire at least 5 Saudi employees to prove its "genuine operation" by improving its Saudization level. This also brings direct cost pressures:

(1) Bearing salaries for local employees;

(2) GOSI (General Organization for Social Insurance) contributions and long-term employment responsibilities;

(3) Synchronous increase in enterprise management and compliance costs.

It is not difficult to see that regardless of which path is chosen, the initial investment of enterprises will increase exponentially, and the space for "low-cost market testing" has been greatly compressed.

3. Clear Policy Signal: Reject "Shell Companies", Welcome Physical Operations

The tightening of the work visa policy is not a temporary adjustment, but an inevitable choice as Saudi Arabia’s "Vision 2030" enters a deep-water phase. The Saudi government hopes to promote foreign-funded enterprises to truly settle and operate, create genuine local jobs, rather than simply occupying policy dividends and establishing "shell companies".

According to the latest system rules of MHRSD, when a newly registered enterprise applies for its first work visa, the system will automatically link and verify the Balady license or Saudization compliance status. The work visa approval channels for the following three types of enterprises have been substantially closed:

(1) Enterprises that only use co-working space addresses;

(2) Enterprises that have long relied on hosting models;

(3) "Shell companies" without genuine office space or local employees.

This change is not only an increase in administrative approval thresholds, but also a complete reshaping of enterprise cost structures. In the past, enterprises could send management to start business development at extremely low costs; now, even for the application of work visas for management, enterprises need to first invest in the cost of long-term office leasing or hiring 5 local employees.

Saudi Arabia’s policy dividends still exist, but the overall environment is becoming more compliant.

4. Kunity’s Suggestion: Understand Lease Costs and Relevant Market Practices in Advance

Kunity believes that based on this change in visa policy, before deciding or preparing to expand overseas to Saudi Arabia, Chinese-funded enterprises should first focus on understanding the average lease costs of office buildings in Saudi Arabia’s core cities, the flexibility of lease terms, and relevant market practices.

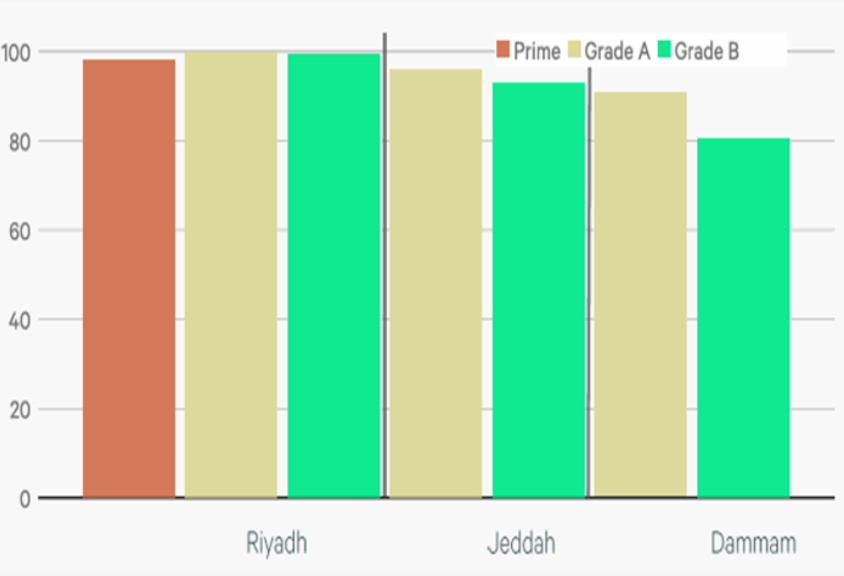

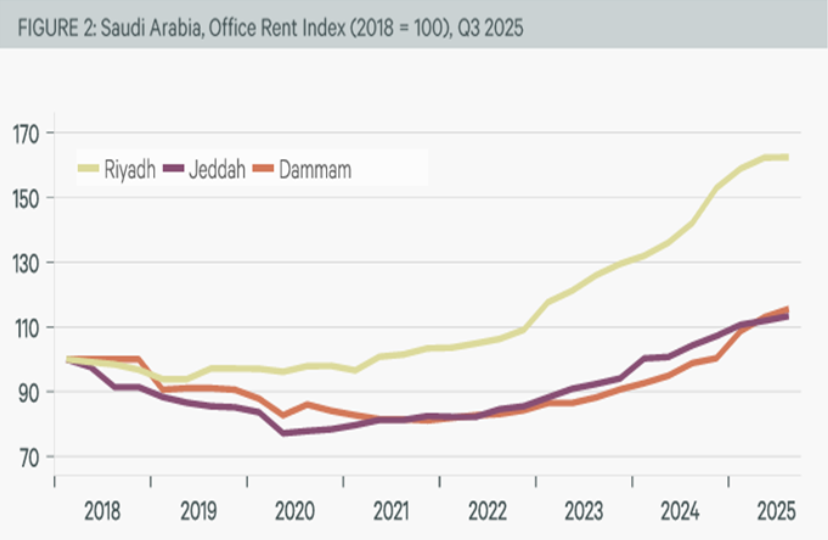

According to professional data provided by Kunity for the Riyadh office building market in Saudi Arabia in Q3 2025:

(1) The Riyadh office building market is currently booming with a tight supply: the overall vacancy rate is only 2%; the average rent for Prime Grade A office buildings reaches RMB 501.94 per square meter per month, and the average rent for Grade A office buildings reaches RMB 396.27 per square meter per month; the overall average market rent has increased by 15% year-on-year compared with last year.

(2) The newly delivered office building area in Riyadh in Q3 2025 was 200,000 square meters, of which 88% is located in North Riyadh; the expected delivered area in Q4 will drop to only 40,000 square meters.

(3) In the 2026-2027 period, it is expected that 1.3 million square meters of new office buildings will be delivered, of which 75% will still be located in North Riyadh, and 80% will be constructed by private developers.

(4) In terms of market practices:

- The minimum lease term in Saudi Arabia is 3-5 years;

- The deposit is usually 10% of the annual rent;

- Rent is typically paid quarterly (for the next 4 months) in advance;

- Insurance fees and agency commissions for the leased area are usually borne by the tenant.

Overall, for a certain period in the future, the office building leasing market in Saudi Arabia will remain a "landlord’s market". If tenants want to lease high-quality properties with high building grades and prime locations, they will have to face fierce competition and may have to pay higher lease costs than expected.

(Occupancy Rates of Various Grade Buildings in Riyadh, Jeddah, and Dammam, Saudi Arabia)

(Rent Index Trends in Riyadh, Jeddah, and Dammam, Saudi Arabia)