As a core country and industrial heart of Europe, Germany boasts a solid industrial foundation spanning automotive, machinery, and chemical sectors, along with a dense cluster of hidden champion enterprises. For Chinese companies venturing overseas, particularly those in manufacturing, Germany has long held profound strategic value and significance.

Today, Kunity will leverage its professional insights and the latest quarterly market data to provide a comprehensive overview of the office leasing market dynamics in six major German cities:

Berlin, Munich, Cologne, Düsseldorf, Frankfurt, and Hamburg.

01 Berlin | Q3 2025

The activity level of Berlin’s office leasing market in the first three quarters of 2025 has declined compared with previous years:

The total absorption volume in Q1-Q3 reached 366,400 square meters, down 27% from the 5-year average. The single-quarter absorption in Q3 stood at 116,400 square meters, an 8% year-on-year decrease.

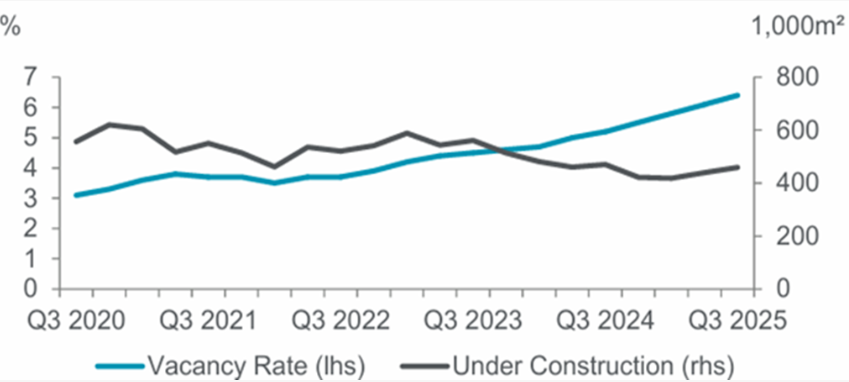

The overall vacancy rate hit 9.8%, with the total vacant area amounting to 2,110,000 square meters—an increase of 47,600 square meters from Q2.

The total newly completed area in Q1-Q3 was 270,200 square meters, slightly lower than the same period in 2024, while the total under-construction area reached 957,400 square meters.

The overall average market rent was €26.85 per sqm per month (approx. RMB 219.93 per sqm per month). For Grade A office buildings in the CBD core area, the average rent surged to €45 per sqm per month (approx. RMB 367.44 per sqm per month).

This has led to an increasingly pronounced polarization in rental trends, coupled with escalating preferential policies: the average rent-free period for 5-year leases in prime locations has now extended to 6 months—one month longer than a year ago.

(Grade A Office Vacancy Rate & Under-Construction Area in Berlin)

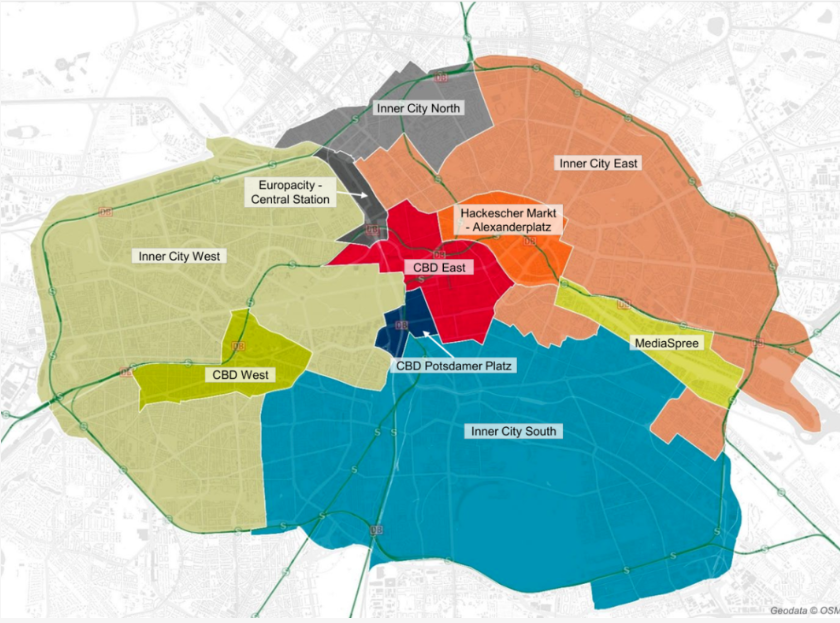

(CBD Business District Map of Berlin)

02 Munich | Q3 2025

Similar to Berlin, the activity of Munich’s office leasing market in Q1-Q3 2025 dropped noticeably against the multi-year average:

The total absorption volume in Q1-Q3 reached 401,600 square meters, a 12.5% decrease from the 5-year average and a 24% drop from the 10-year average.

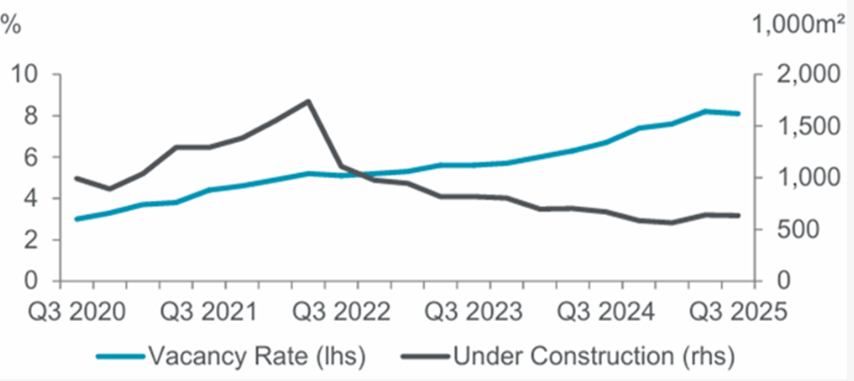

The overall vacancy rate was 8.1%, with the total vacant area at 1,770,000 square meters, up 1.4% year-on-year.

The total newly completed area in Q1-Q3 was 162,700 square meters, and the total under-construction area stood at 633,300 square meters.

The overall average market rent was €26.00 per sqm per month (approx. RMB 212.97 per sqm per month), a 2.6% year-on-year increase. For Grade A office buildings in the CBD core area, the average rent reached €55.00 per sqm per month (approx. RMB 452.09 per sqm per month).

Munich’s office rents remained high in Q3, though some areas saw a plateau in rental growth.

(Grade A Office Vacancy Rate & Under-Construction Area in Munich)

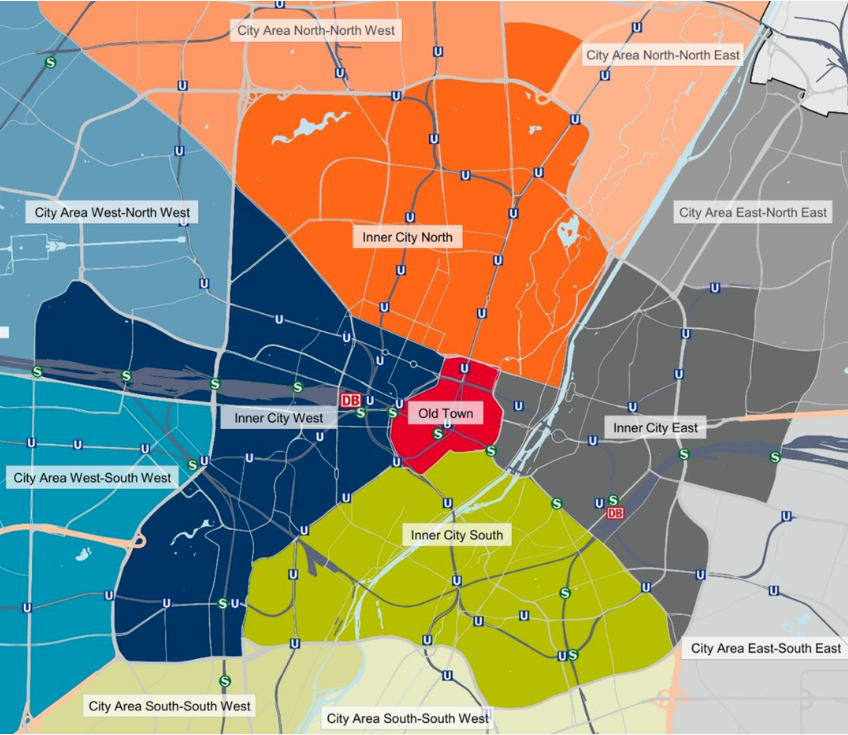

(CBD Business District Map of Munich)

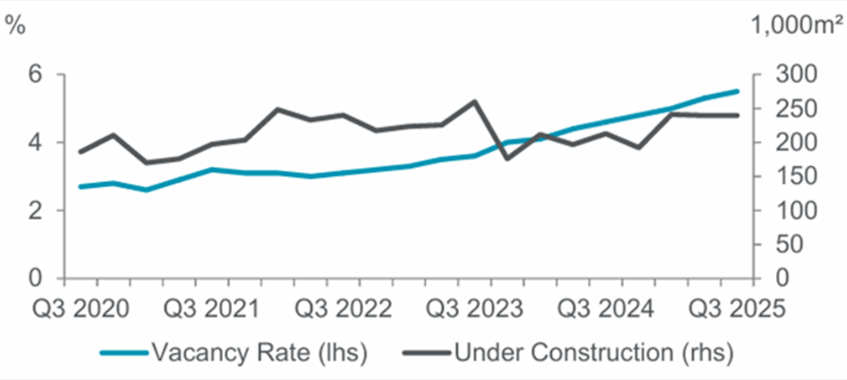

03 Cologne | Q3 2025

The activity of Cologne’s office leasing market in Q1-Q3 2025 improved compared with 2024, but still lagged behind the 10-year average:

The total absorption volume in Q1-Q3 was 164,800 square meters, a 4% increase year-on-year but a 21% decrease from the 10-year average.

The overall vacancy rate was 5.5%, with the total vacant area at 470,200 square meters, up 0.2% from Q2 and 0.9% year-on-year.

The total newly completed area in Q1-Q3 was 35,100 square meters—higher than the same period in 2024 but lower than the 5-year and 10-year averages. The total under-construction area was 239,500 square meters.

The overall average market rent was €22.60 per sqm per month (approx. RMB 185.84 per sqm per month), a year-on-year increase of €4. For Grade A office buildings in the CBD core area, the average rent reached €34.00 per sqm per month (approx. RMB 277.62 per sqm per month).

Rents for prime office spaces in Cologne remained stable, while the overall average rent rose steadily—a trend highlighting the market’s ongoing flight to quality assets. Tenants are increasingly favoring modern office buildings that meet ESG standards and enjoy convenient transportation links to the city center. These high-quality properties are expected to maintain strong demand in the coming quarters.

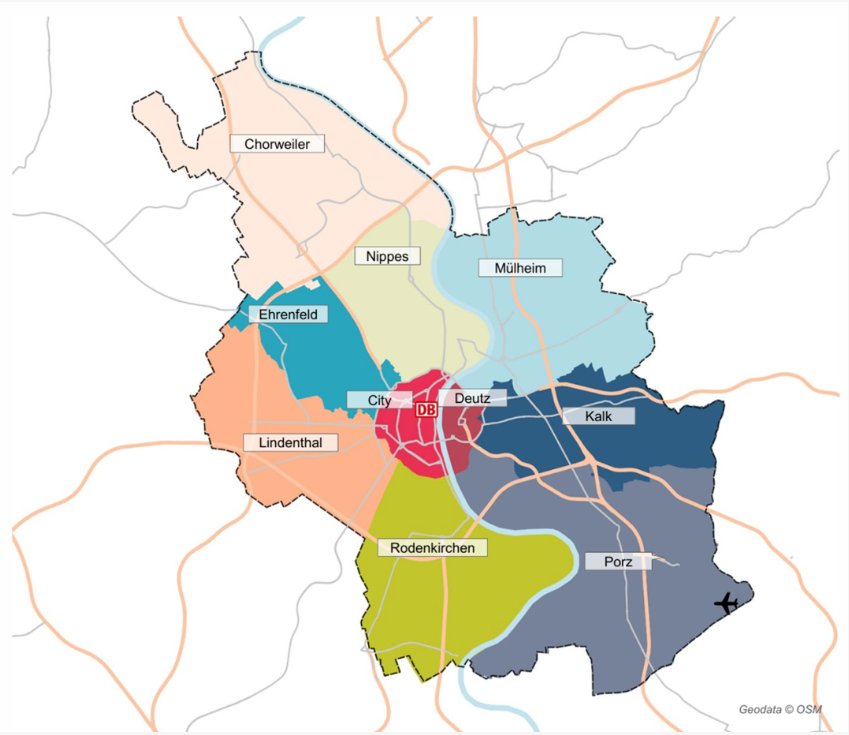

(Grade A Office Vacancy Rate & Under-Construction Area in Cologne)

(Business District Map of Cologne)

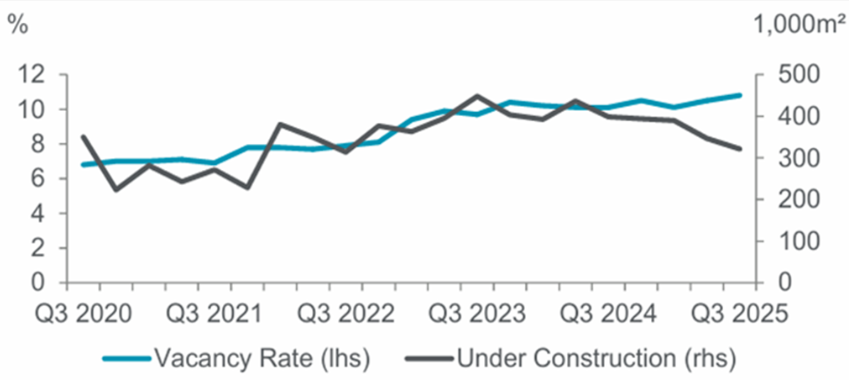

04 Düsseldorf | Q3 2025

Düsseldorf’s office leasing market showed sluggish activity in Q1-Q3 2025:

The total absorption volume in Q1-Q3 was 162,000 square meters, down 18% from the 5-year average and 37% from the 10-year average. The single-quarter absorption in Q3 was 58,900 square meters.

The overall vacancy rate was 10.8%, with the total vacant area at 1,010,000 square meters—up 0.3% from Q2 and 0.7% year-on-year.

The total newly completed area in Q1-Q3 was 131,500 square meters, and the total under-construction area stood at 321,300 square meters.

The overall average market rent was €19.80 per sqm per month (approx. RMB 162.44 per sqm per month), a 0.8% year-on-year increase. For Grade A office buildings in the CBD core area, the average rent reached €46.00 per sqm per month (approx. RMB 375.60 per sqm per month).

Rents for prime office spaces in Düsseldorf are projected to rise further. Driven by high-premium lease transactions, the overall average market rent is also expected to climb in tandem.

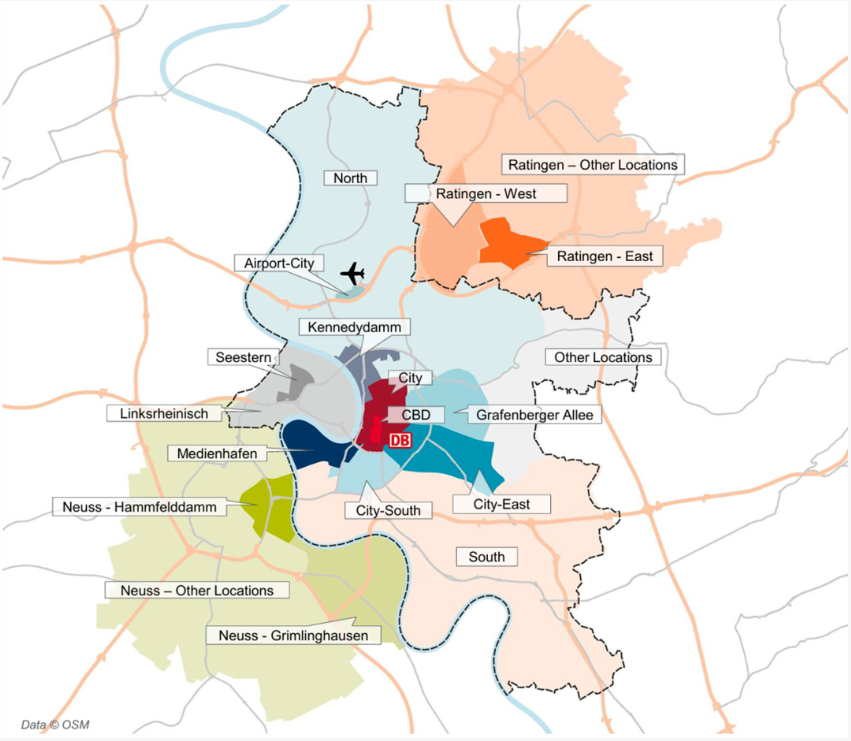

(Grade A Office Vacancy Rate & Under-Construction Area in Düsseldorf)

(Business District Map of Düsseldorf)

05 Frankfurt | Q3 2025

Frankfurt’s office leasing market demonstrated robust growth momentum in Q1-Q3 2025, with significant increases across key metrics:

The total absorption volume in Q1-Q3 reached 458,000 square meters, soaring 77% from the 5-year average and 46% from the 10-year average. In just three quarters, transaction volume has already exceeded the full-year 2024 level by nearly 30%.

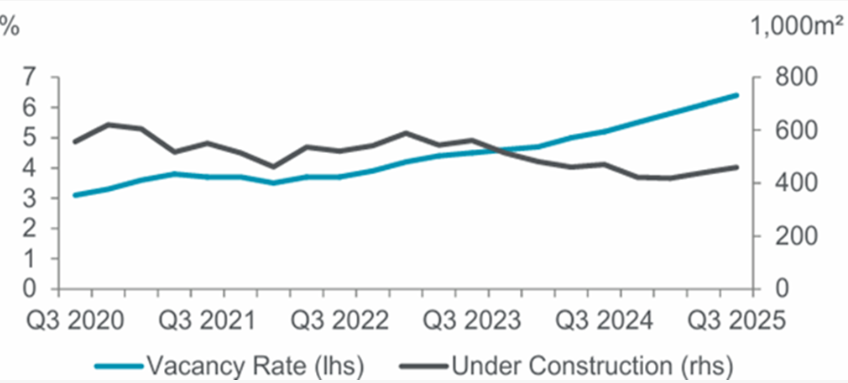

The overall vacancy rate was 11.5%, a 1.8% year-on-year increase, with the total vacant area at 1,350,000 square meters.

The total newly completed area in Q1-Q3 was 125,100 square meters, and the total under-construction area stood at 398,500 square meters.

The overall average market rent was €33.70 per sqm per month (approx. RMB 275.17 per sqm per month), a staggering 34.3% year-on-year increase. For Grade A office buildings in the CBD core area, the average rent reached €52.00 per sqm per month (approx. RMB 424.60 per sqm per month), a 7.2% year-on-year rise.

Nearly 40% of Frankfurt’s office absorption volume in 2025 came from high-premium office projects, compared with an average share of around 20% over the past five years. This shift has driven a significant uptick in rental levels.

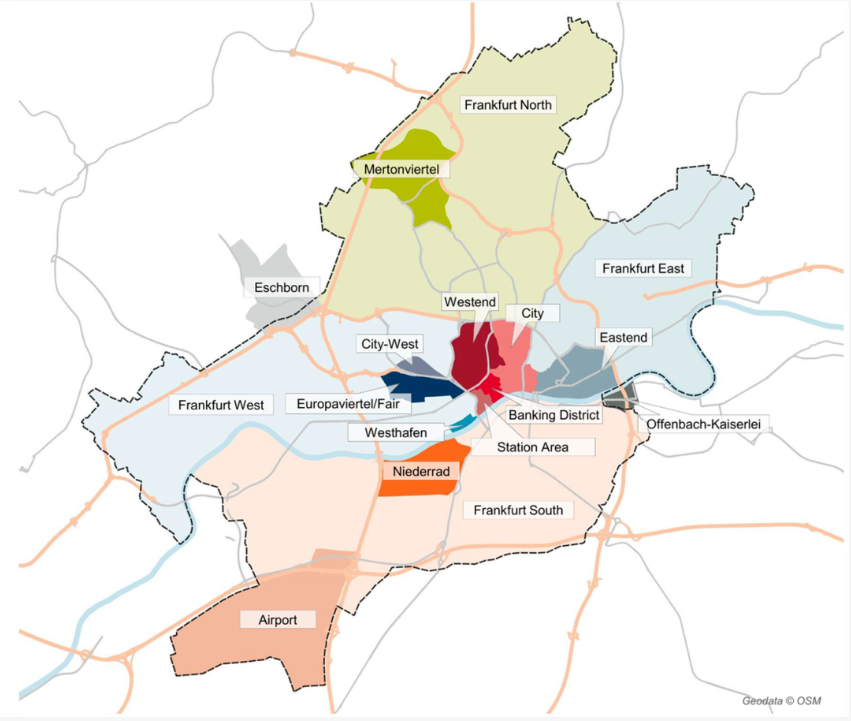

(Grade A Office Vacancy Rate & Under-Construction Area in Frankfurt)

(Business District Map of Frankfurt)

06 Hamburg | Q3 2025

The activity of Hamburg’s office leasing market in Q1-Q3 2025 remained below the multi-year average:

The total absorption volume in Q1-Q3 was 308,900 square meters, a 4% year-on-year increase but a 10% decrease from the 5-year average. The single-quarter absorption in Q3 was 96,000 square meters.

The overall vacancy rate was 6.4%, with the total vacant area at 915,500 square meters, a 25% year-on-year increase.

The total newly completed area in Q1-Q3 was 144,000 square meters, and the total under-construction area stood at 459,800 square meters, a 2% year-on-year decrease.

The overall average market rent was €22.20 per sqm per month (approx. RMB 182.13 per sqm per month), a 4.7% year-on-year increase. For Grade A office buildings in the CBD core area, the average rent reached €36.00 per sqm per month (approx. RMB 293.95 per sqm per month), a 4% year-on-year rise.

Rents for Grade A office buildings in Hamburg’s core area remained stable, while the overall average market rent hit a new peak.

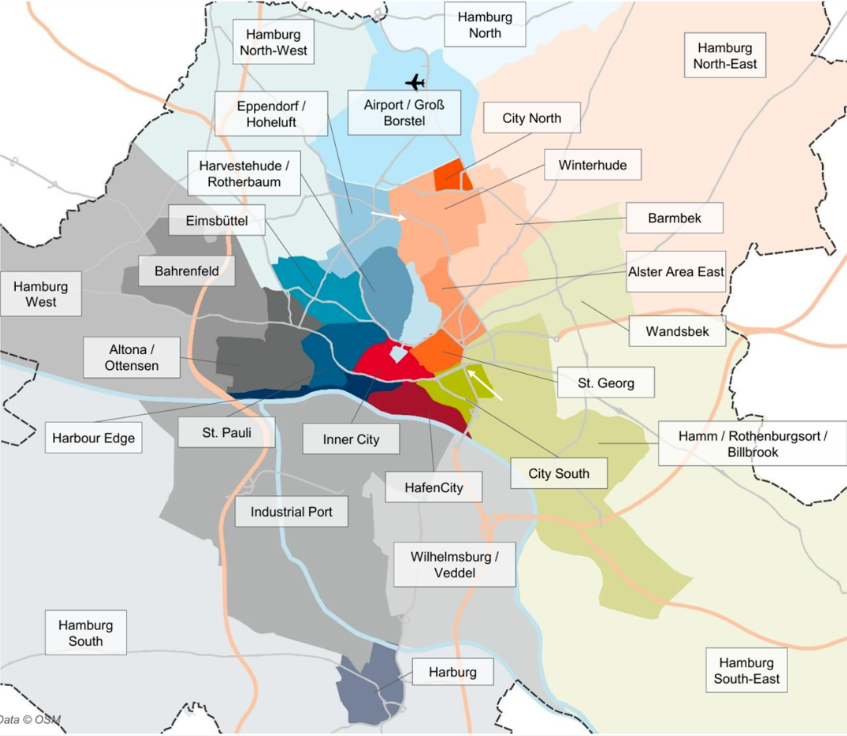

(Grade A Office Vacancy Rate & Under-Construction Area in Hamburg)

(Business District Map of Hamburg)