The Russian commercial real estate market is undergoing an unprecedented structural transformation in 2025:

Fueled by upgraded transportation infrastructure and policy dividends, both prices and supply of industrial and warehousing land have witnessed an explosive surge. Amid cost fluctuations and demand upgrading, office fit-outs are accelerating their iteration toward green, intelligent, and human-centric directions.

Based on the latest professional market data, Kunity conducts an in-depth analysis of the latest market conditions, key figures, and practical recommendations for these two core sectors, providing Chinese enterprises with a comprehensive decision-making reference.

I. Industrial and Warehousing Land: Transportation-Driven Value Surge and Supply Restructuring Reshaping the Market

Upgraded Core Data: Explosive Growth in Prices and Rents

Record-breaking price hikes: The average unit price of industrial and warehousing land in the Moscow area has doubled over five years, reaching 31.5 million Russian rubles per hectare (approximately RMB 2.84 million per hectare) in Q3 2025; the unit price of industrial-specialized land has soared even higher to 39 million Russian rubles per hectare (approximately RMB 3.52 million per hectare). Among all areas, land plots around the Central Ring Road (TsKAD) (27-47 km from the Moscow Ring Road, MKAD) have seen the sharpest price growth, surging 3.5 times from 2019 to 2025 and emerging as the market's "top gainer".

Synchronized rent surges: The average rent for high-quality warehouses has tripled over five years, stabilizing at 11,802 Russian rubles per square meter per year (approximately RMB 1,065 per square meter per year) in 2025. By radius, the core area within 10 km of the MKAD commands the highest rents, the 11-35 km radius has the fastest rent growth, while in remote areas beyond 36 km, though rents still rise, they remain around 40% lower than those in the core area overall.

Substantial narrowing of regional price gaps: In 2019, the maximum gap between rents of land plots in different directions and the market average reached 18%, which has narrowed to 8.5% in 2025. Improved transportation infrastructure has effectively offset the inherent geographical disparities.

Supply Structure Transformation: Medium and Small Plots Becoming the Market Mainstay

Doubled total supply: In 2025, there are about 100 "actively marketed" land plots for sale in the market, with a total area of 4,600 hectares, doubling the supply compared to 2019. The incremental supply mainly comes from agricultural land, whose proportion has skyrocketed from 12% to 40%, becoming the main supply driver.

"Lightweight" plot scale: The proportion of large plots (≥100 hectares) is on a continuous decline, small plots (≤10 hectares) are supplied in bulk for the first time, and the proportion of medium plots (50-100 hectares) has even surged from 7% to 57%. This change allows small and medium-sized enterprises (SMEs) to acquire suitable industrial land without bearing huge capital pressure, significantly enhancing market inclusiveness.

Diversified land use types: Land plots for sale cover urban land, agricultural land, industrial and other use land. Among them, agricultural land has become an important option for enterprises to acquire land at low cost due to relaxed policies (flexible adjustment of use while retaining agricultural attributes).

Geographic Selection Guide: Value Classification of Different Regions

High-priced core areas: Land plots along the Kyiv Highway and Minsk Highway boast the highest prices, mainly due to supply shortages and proximity to Moscow's core consumer market; the Leningrad Highway has maintained high land prices for a long time by virtue of the industrial cluster advantages around Sheremetyevo Airport.

Cost-effective potential areas: Land plots along the New Riga Highway have relatively low prices as two-thirds of the plots are more than 45 km from the MKAD, suitable for production-oriented enterprises sensitive to transportation costs and with slow inventory turnover; land plots along the M-4 "Don" Highway have the lowest prices, and despite limited supply and remote locations, they feature obvious land cost advantages, making them ideal for constructing large-scale warehousing centers.

Value depressions: Land plots in the New Moscow area and some sections of the Leningrad Highway are 40%-130% higher than the market average price, but have become key layout areas for long-term investors due to improved planning and gradual transportation upgrades.

Key Influencing Factors: Dual Empowerment of Transportation and Policies

Transportation infrastructure reshaping the landscape: The first section of the Central Ring Road (TsKAD) opened to traffic in 2017, and the ring operation was realized in 2021, which greatly improved "radial mobility" and shortened the commute time from suburban plots to Moscow. Land plots with poor transportation access in the past have not only seen rent hikes but also attracted a large amount of warehousing demand, completely changing the single logic that "the closer to the urban area, the more valuable the land".

Continuous release of policy dividends: The new land administration law taking effect on March 1, 2026, allows local governments to flexibly adjust the use of agricultural land and shorten the approval cycle for agriculture-related projects; investors can receive a tax deduction of up to 100% for the cost of constructing supporting facilities such as transportation and energy, further reducing land acquisition and development costs.

Kunity's Investment and Utilization Recommendations: Demand-Oriented Matching for Higher Efficiency

Optimal choice for speculative development: Land plots within 30 km of the MKAD feature high unit prices and stable rents, suitable for short-term speculative development with short realization cycles and high returns.

Adaptation for end users: Land plots beyond the coverage of the Central Ring Road (TsKAD) outside the Moscow Ring Road (MKAD) are 50% lower than the market average price, especially suitable for production enterprises with long inventory turnover cycles and large e-commerce platforms to layout regional warehousing centers, which can significantly reduce land cost input.

First choice for SMEs: Medium plots of 50-100 hectares with moderate area and low capital pressure are suitable for the production and warehousing needs of SMEs, making them the "golden choice" in the current market.

II. Office Fit-outs: Obvious Cost Differentiation, Green and Intelligent Becoming Core Competitiveness

Cost Detail Analysis: Cost Composition and Material Selection for Different Grades

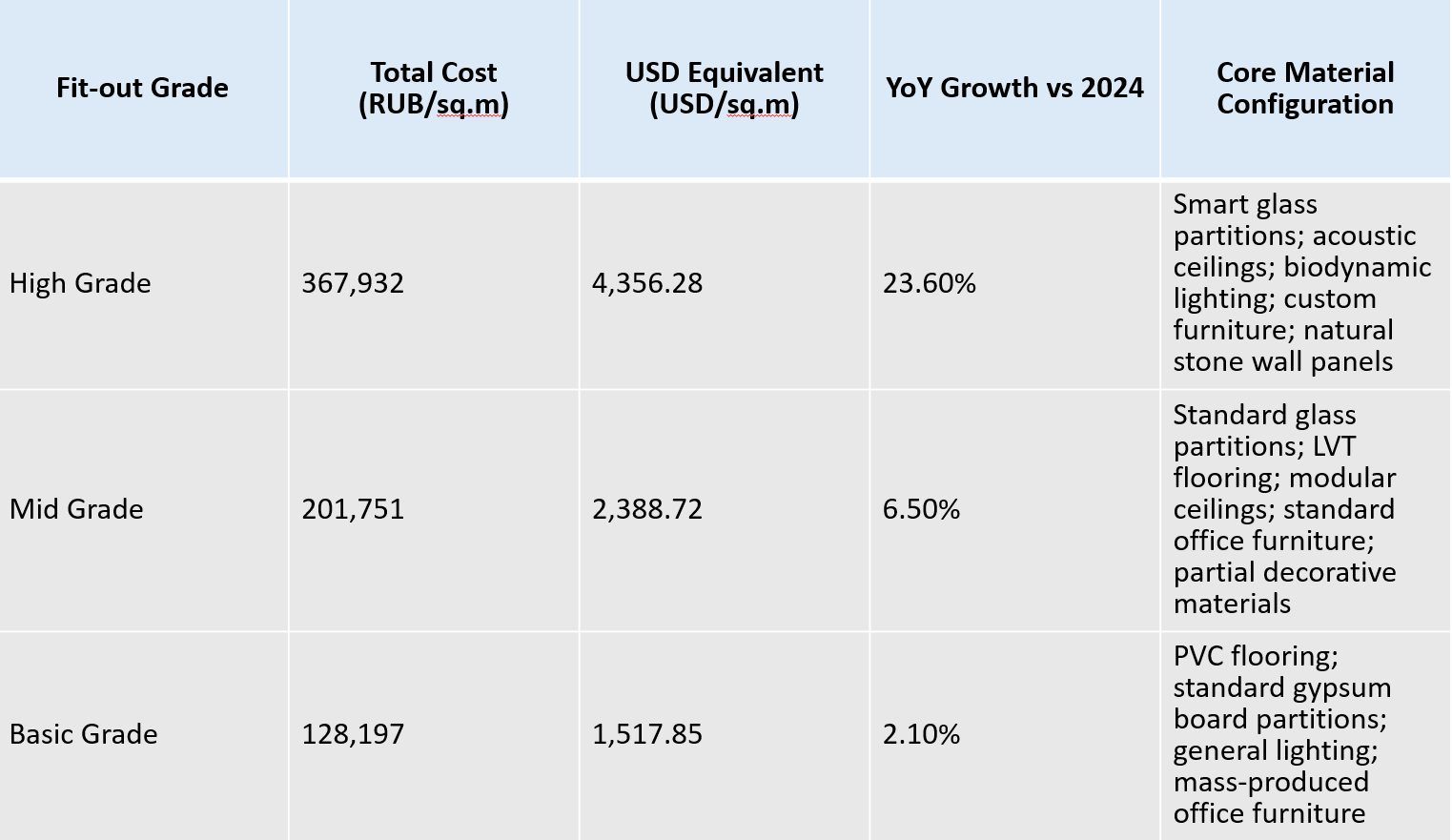

Comparison Table of Fit-out Costs for Different Grades (2025, VAT excluded)

Key material costs exposed: The unit price of high-grade office chairs reaches 93,874 Russian rubles (approximately RMB 8,467), and the cost of phone booths exceeds 1 million Russian rubles (approximately RMB 90,000); mid-grade glass partitions cost 18,750 Russian rubles per square meter (approximately RMB 1,691), while basic-grade ones are only 11,537 Russian rubles (approximately RMB 1,040); for floor paving, high-grade options cost 4,311 Russian rubles per square meter (approximately RMB 389), and basic-grade ones are merely 1,917 Russian rubles (approximately RMB 173). The material cost gap between different grades can reach 2-3 times.

Cost structure revealed: In high-grade fit-outs, construction accounts for 85% (312,839 Russian rubles per square meter; approximately RMB 28,218 per square meter), electromechanical systems (ventilation, air conditioning, fire protection, intelligent control) account for 33.3%, furniture solutions 13%, and design and project management only 2%. It is evident that the core costs of high-end fit-outs are concentrated in hard decoration and system configuration.

New Industry Trends: Comprehensive Upgrades in Materials, Modes and Experience

Changes in the material supply pattern: The number of official suppliers from unfriendly countries has dropped sharply, the price of parallel imported materials has risen by more than 30% with delivery cycles extended by 2-3 months; local suppliers are rising rapidly, and representatives of some former foreign brands have transformed into Russian local enterprises, providing faster supply and after-sales support and becoming the mainstream choice in the market.

Two fit-out modes to choose from: The traditional Design, Bid, Build (DBB) mode is suitable for enterprises pursuing personalized design, with a project cycle of 8-10 months for projects ≤10,000 square meters but no fixed quotation; the Design & Build (D&B) mode is more efficient, with the cycle shortened to 7-8 months, and is responsible for by a single entity with fewer changes and controllable costs, becoming the first choice for SMEs.

Acoustic experience as a core demand: The noise problem in open office spaces has become increasingly prominent, leading to a surge in market demand for acoustic solutions. Efficient solutions include: equipping workstations with acoustic screens ≥110 cm high, using acoustic curtains in meeting rooms, installing suspended acoustic panels in open areas, and moving equipment such as printers and coffee machines to independent soundproof zones. The use of professional acoustic materials can reduce the noise of the office environment by 15-20 decibels and improve employee concentration by 30%.

Green and Intelligent: Core Competitiveness of the Future Office

Significant premium for green certification: Offices with green building certification command a rent 3-4% higher than the market average and a selling price 8-16% higher. In 2025, the number of green building certification projects across Russia has exceeded 1,300, and 80% of the projects are transacted in the form of entire floors, entire buildings or large blocks (≥1,000 square meters), becoming an important carrier for large enterprises to demonstrate social responsibility.

Popularization of intelligent office systems: "Smart office" solutions have covered the needs of employees, enterprises and property owners. For employees, functions such as workstation reservation, navigation and catering ordering can be realized through enterprise APPs; for enterprises, intelligent systems can optimize space utilization and reduce rent and administrative costs by 20%; for property owners, real-time monitoring of building energy consumption can be achieved, enabling automated management of electromechanical equipment and reducing operating costs by more than 15%.

Human-centric design as a rigid demand: The multi-generational office environment requires spaces to adapt to the needs of employees of different age groups: independent offices for Generation X (1964-1984), collaborative areas for Generation Y (1984-1999), and flexible workstations and leisure spaces for Generation Z (1999-2010). At the same time, the Well-being concept has taken root in people's hearts, with a large number of green plants, massage chairs, sports areas and even on-site medical experts introduced into office areas, effectively reducing employee pressure and improving loyalty.

Cost Control Guide: Avoid These Hidden Traps

Material selection: Prioritize locally certified green materials, which are not only 25-30% cheaper than imported materials with shorter delivery cycles but also eligible for policy subsidies; modular materials (such as prefabricated partition walls and standardized suspended ceilings) can reduce construction costs by more than 19% and are easy to install.

Construction timing: Avoid the peak period of large-scale projects in 2026, when labor demand will surge and salaries may rise by 15-30%. It is recommended to complete the construction bidding by the end of 2025.

Acoustic investment: Every 1 Russian ruble invested in acoustic materials in the early stage can reduce 3 Russian rubles of employee efficiency loss in the later stage. It is recommended to increase the proportion of the acoustic budget to 5-8% of the total fit-out cost, with key investment in open office areas and meeting rooms.

III. Kunity's Summary and Ultimate Recommendations for the 2025 Russian Market

Kunity believes that the Russian commercial real estate market has entered a critical period of value restructuring: Driven by the dual forces of transportation infrastructure and policy dividends, the industrial land market has a more rational supply structure, and despite price hikes, there are still investment opportunities in segmented sectors; although the office fit-out market faces cost pressure, the transformation toward green, intelligent and human-centric directions is creating new value growth points.

From an investment perspective, medium plots around the TsKAD and potential plots in the New Moscow area promise favorable long-term returns; for Chinese enterprises preparing to establish a presence in Russia, the selection of industrial land needs to match their own logistics needs and capital strength, while office fit-outs should strike a balance between cost and employee experience based on staff structure and brand positioning — SMEs can opt for basic to mid-grade fit-outs, and large enterprises can layout green and intelligent office spaces to enhance brand competitiveness.