The Moscow office market is thriving in 2025, characterized by the core trends of high supply, low vacancy and steady growth:

The new quarterly supply of 473,000 square meters has neared the annual supply of some years, yet it has not triggered a rebound in market vacancy rate. Instead, it has driven a sustained uptrend in rental and sales prices. Based on the latest professional market data, Kunity will accurately analyze the real-time dynamics of the Moscow office market and provide detailed decision-making references for Chinese enterprise partners.

1. Supply Side: New Supply Hits a Quarterly High, Grade A Offices Dominate the Market

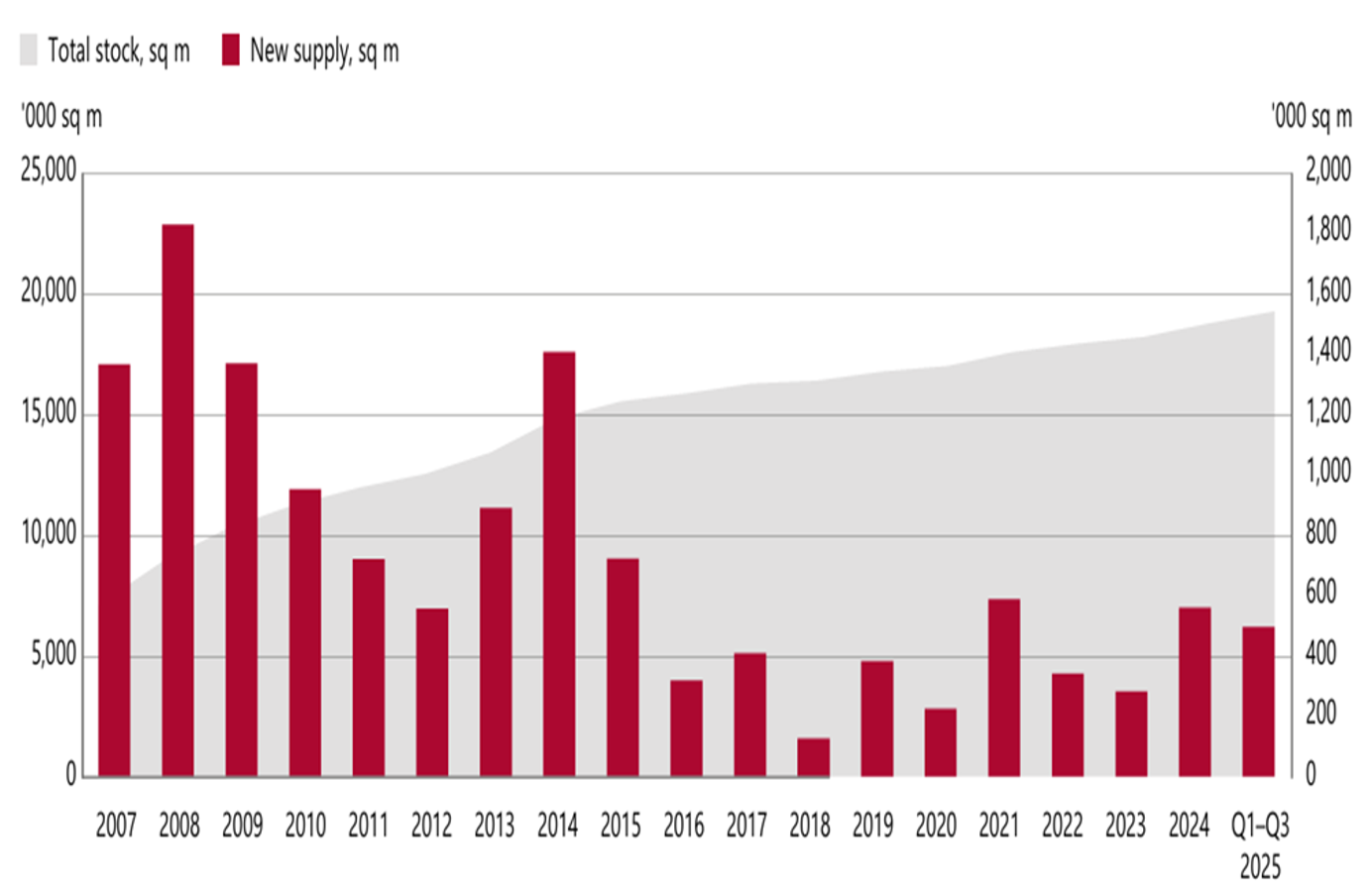

(1) The total stock of Moscow's office market reached 19.3 million square meters in Q3: including 6.5 million square meters of Prime + Grade A offices and 12.8 million square meters of Grade B offices, with the market structure continuing to tilt towards high-end segments.

(2) Explosive growth in new supply: From January to September 2025, 11 projects obtained completion permits with a total leasable area of 495,400 square meters, a year-on-year increase of 30%; the new supply in Q3 stood at 473,000 square meters, all of which are Grade A offices.

(3) Key new projects: Led by the National Space Center (167,000 square meters, accounting for 35% of the total quarterly supply), Slava 4 Business Center (101,500 square meters) and iCity Space (92,200 square meters).

(4) Full-year supply forecast: The total new supply of Moscow's office market in 2025 is expected to reach 1.2 million square meters (the actual figure may be 800,000-900,000 square meters), with 62% for sale, 13% for lease, 25% for Build-to-Suit (BTS) projects.

(Moscow Office Market: Total Stock & New Supply Trend Chart)

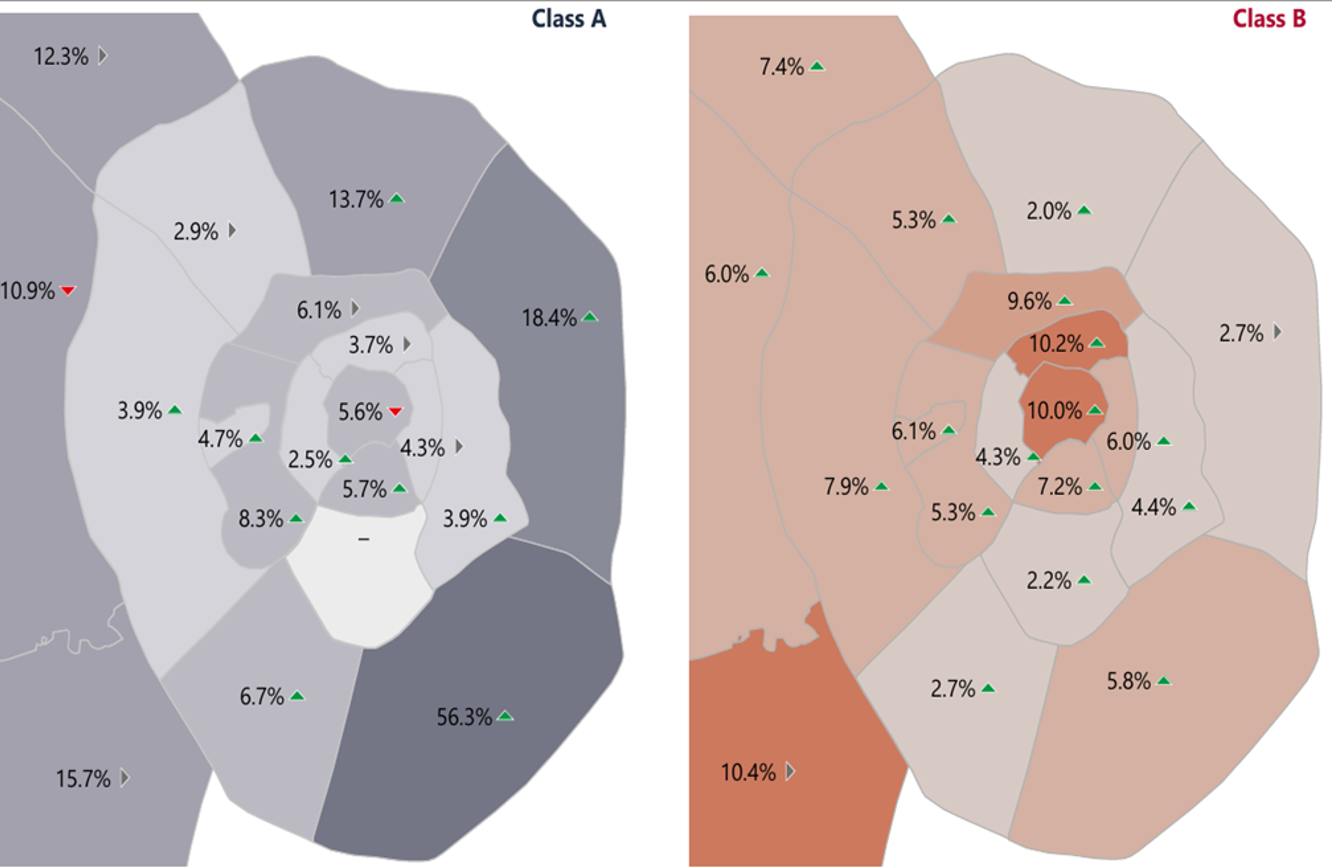

2. Vacancy Rate: Sustained Decline Nears Historical Extremes with Obvious Regional Differentiation

(1) The overall market vacancy rate dropped to 5.5%: Since the start of the year, the vacancy rate of Grade A offices has slightly decreased from 7.2% to 7.1%, and that of Grade B offices has fallen from 5.2% to 4.7%, both approaching the historical lows in 2007 (1.1% for Grade A, 4.5% for Grade B).

(2) Scarcity of Prime offices becomes prominent: The vacancy rate has dropped by nearly one-third from the end of 2024 to only 4.5%, with demand for high-quality properties outstripping supply.

(3) Significant regional disparities: The vacancy rate in the core areas within the MKAD (Moscow Ring Road) is generally below 5%, while that in the areas outside the MKAD reaches 13.4%, and the rate between the Third Ring Road and MKAD stands at 8.5%.

(Moscow Office Market: Vacancy Rates of Grade A & B Offices by Business District)

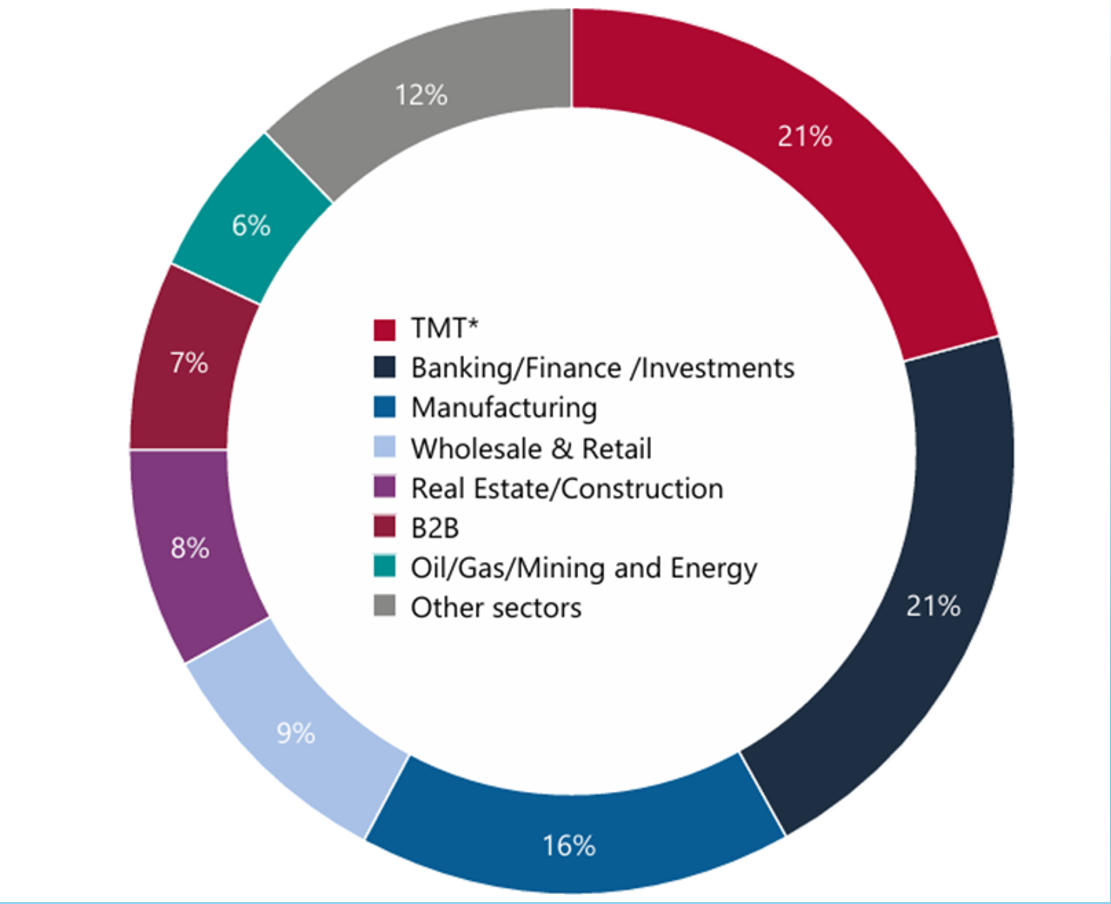

3. Demand Side: Sales Transactions Account for Over Half of the Total, TMT and Financial Sectors Drive Demand

(1) Net absorption reached 536,600 square meters in Q3: Although it declined from 776,000 square meters in the same period of 2024, it remains at a high level, easing the pressure of absorbing new supply.

(2) Demand structure features strong sales and weak leasing: Sales transactions account for 53% of the total demand and leasing transactions for 47%; the average single leasing area is 1,636 square meters (an increase of 432 square meters compared with Q4 2024), and the average bulk sales area has risen from 243 square meters to 250 square meters.

(3) Core demand sectors: Technology, Media & Telecommunications (TMT) and Banking, Finance & Investment each account for 21% of the total demand, and manufacturing accounts for 16%. The three sectors together contribute 58% of the overall demand.

(4) Major transaction cases: IKS leased 40,000 square meters in the National Space Center; Lukoil purchased 37,883 square meters in the AFI2B Building; T-Bank acquired 28,785 square meters in the Central Telegraph Building.

(Moscow Office Market: Sectoral Share of Net Absorption)

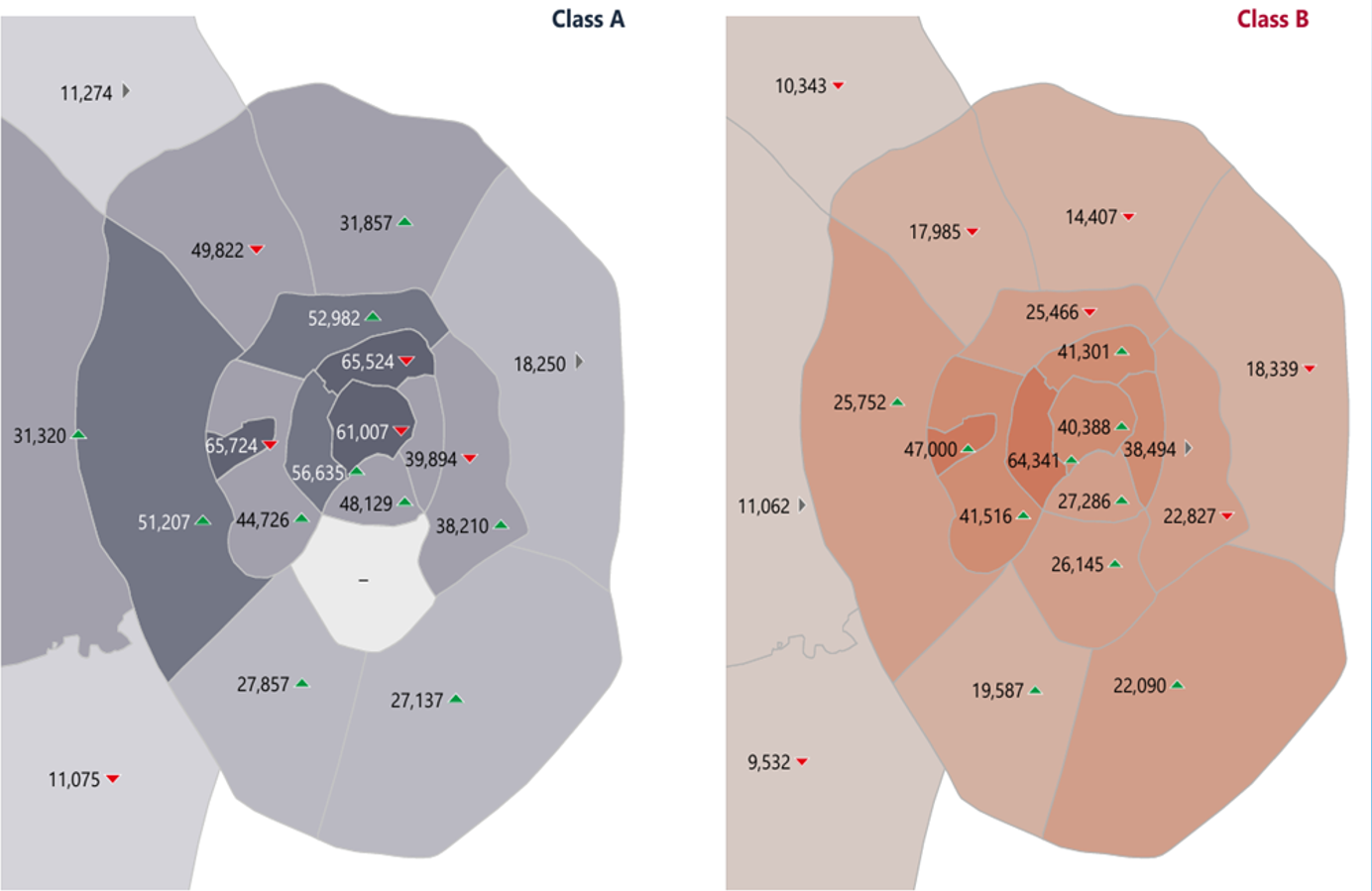

4. Rents & Operating Expenses: All-Round Increase with a Significant Price Gap Between Core and Non-Core Areas

Rent Growth (excluding OPEX and VAT)

(1) Grade A offices: Up 25.6% since the start of the year, reaching 34,401 Russian Rubles per square meter per year (approx. RMB 3,168.33); the rent in core areas within the MKAD hits 42,364 Russian Rubles per square meter per year (approx. RMB 3,901.72), while that in non-core areas outside the MKAD is only 15,918 Russian Rubles per square meter per year (approx. RMB 1,466.95).

(2) Grade B offices: Up 4.9% since the start of the year, standing at 22,423 Russian Rubles per square meter per year (approx. RMB 2,065.16); the rent in areas within the MKAD is 24,682 Russian Rubles per square meter per year (approx. RMB 2,273.21).

(3) Prime offices: The rent reaches 69,153 Russian Rubles per square meter per year (approx. RMB 6,368.99), a 11.6% increase from the end of 2024.

Operating Expenses (OPEX)

(1) Grade A offices: 8,700 Russian Rubles per square meter per year (approx. RMB 801.27)

(2) Grade B offices: 6,000 Russian Rubles per square meter per year (approx. RMB 552.60)

Including core expenditures such as technical operation, cleaning, security and property tax.

Market Rule

The larger the leasing area, the greater the bargaining power: The unit rent of Grade A offices for large-area leasing (over 10,000 square meters) is significantly lower than that for small-area leasing (under 300 square meters).

(Moscow Office Market: Average Rent by Business District, Unit: Russian Rubles per square meter per year)

5. Sales Market: Surging Supply, Small and Medium-Sized Transactions Become the Mainstream

(1) Surging for-sale scale: As of the end of September 2025, the for-sale office area reached 827,000 square meters, nearly tripling that of 2021 and surging 85% year-on-year; the for-sale area of under-construction and newly completed projects stood at 2.3 million square meters, a month-on-month increase of 5.8%.

(2) Steady growth in sales prices: The weighted average sales price of new projects is 433,396 Russian Rubles per square meter (approx. RMB 39,915.77), and the weighted average quoted price of all for-sale office properties is 441,700 Russian Rubles per square meter (approx. RMB 40,689.57), a 2% increase from the start of the year.

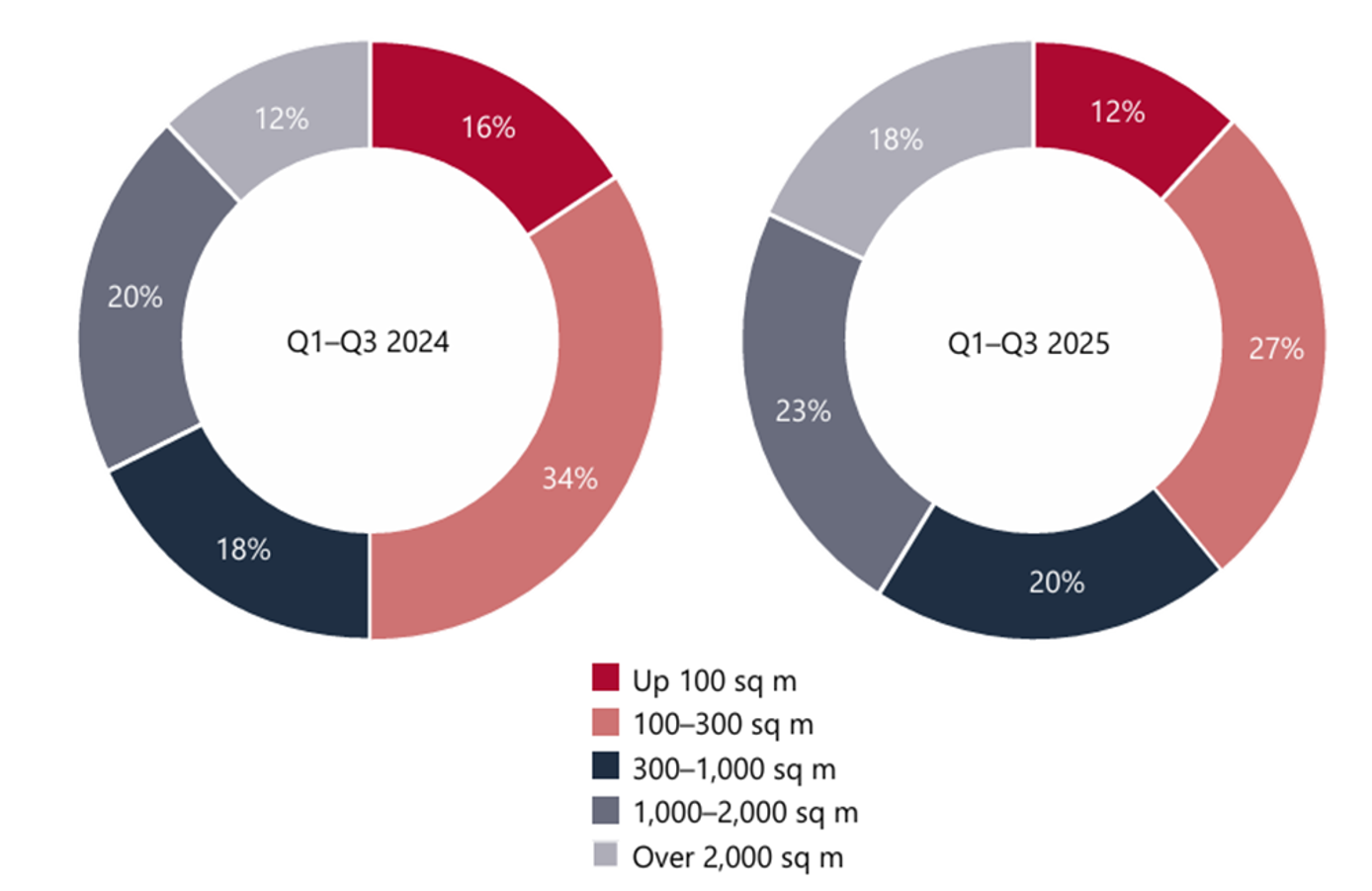

(3) Demand structure: In terms of transaction volume, properties under 100 square meters account for 44% and those between 100-300 square meters for 41%; in terms of transaction area, properties between 100-300 square meters account for 27% and those between 1,000-2,000 square meters for 23%.

(Moscow Office Sales Market: Bulk Sales Demand Structure by Plot & Area)

6. Flexible Office Market: Expanding Scale, Dual Rise in Vacancy Rate and Rent

(1) Market scale reaches 402,000 square meters: With a total of 58,600 workstations, it has become a core carrier for young enterprises and flexible office demand.

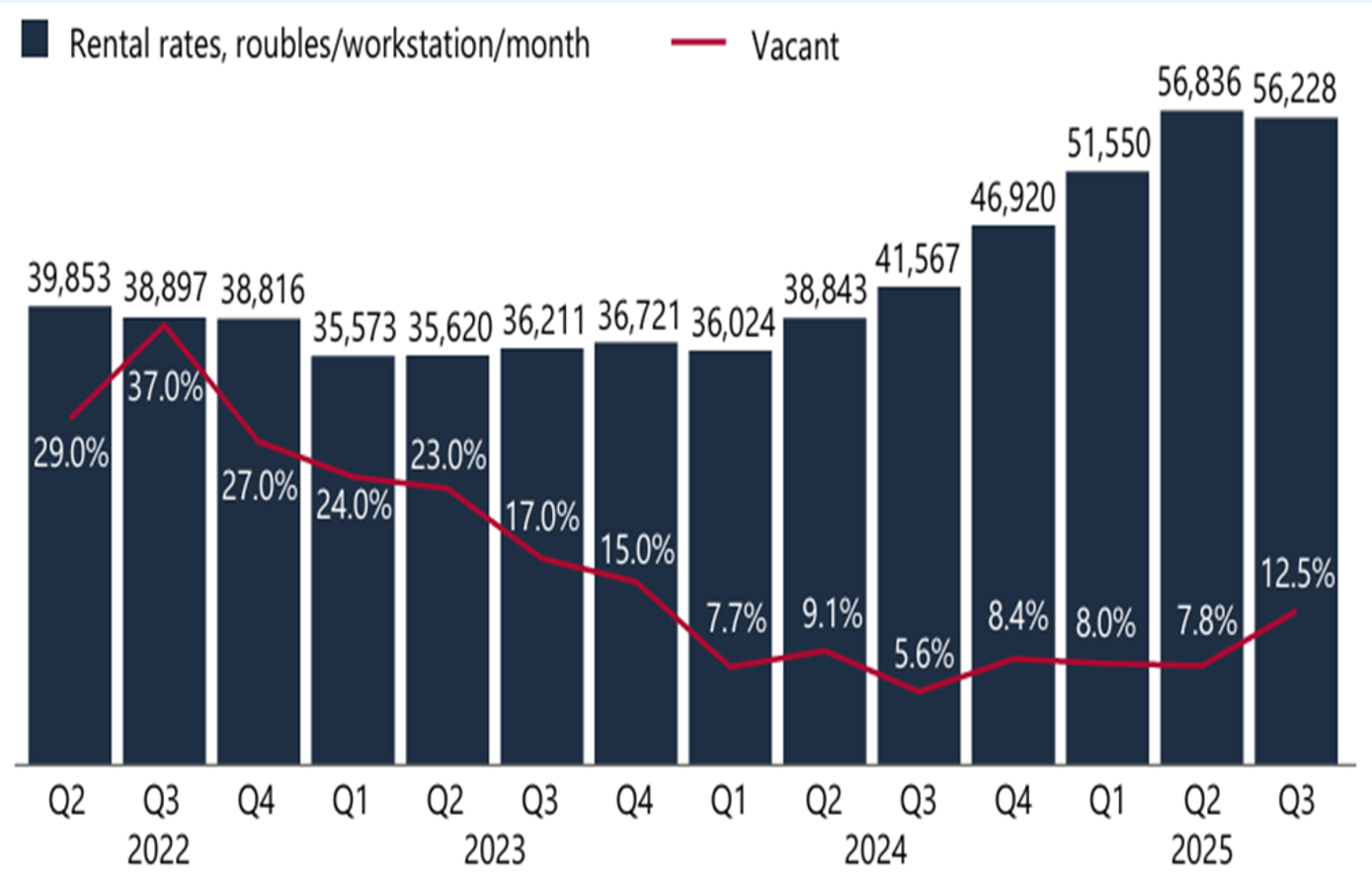

(2) Inverse movement of vacancy rate and rent: The vacancy rate rose by 4.1 percentage points from the end of 2024 to 12.5% (driven by new stations and vacant existing properties), while the monthly rent per workstation increased by 19.8% to 56,228 Russian Rubles per workstation per month (approx. RMB 5,178.6).

(Moscow Flexible Office Market: Average Rent & Vacancy Rate)

7. Future Outlook: Contracting Supply, Slowing but Sustained Growth

(1) New supply may narrow to 800,000-900,000 square meters, 93% of which are Grade A offices, concentrated in the area between the Third Ring Road and MKAD.

(2) Rents and sales prices will continue to rise but at a slower pace than in the past 1.5 years, with the core driving forces remaining low vacancy rate and shortage of high-quality properties.

(3) The vacancy rate will stay at a low level, further approaching historical extremes, and the market supply and demand balance will continue to favor sellers.

Kunity's Conclusion

Kunity believes that the high supply + low vacancy + steady growth pattern of the Moscow office market in 2025 is essentially a precise match between high-end supply and rigid demand:

(1) For investors and developers, the nearly 10% rental-to-sale ratio of Grade A offices in core areas endows them with high allocation value, and high-endization and customization will become the main competitive tracks in the development sector.

(2) For corporate tenants, demand for Prime and Grade A offices in core areas is on a sustained rise, making it crucial to lock in long-term leases in advance to avoid the risk of subsequent rent hikes.

(3) Meanwhile, large-area leasing provides stronger bargaining power; small and medium-sized tenants may consider joint leasing to enhance their negotiation chips.

(4) For short-term temporary demand or project-based teams, more attention can be paid to flexible office spaces, as the 12.5% vacancy rate will bring more property options. For long-term stable demand, traditional office leasing remains the primary choice to balance costs and office stability.